OFFICIAL BALLOT LANGUAGE

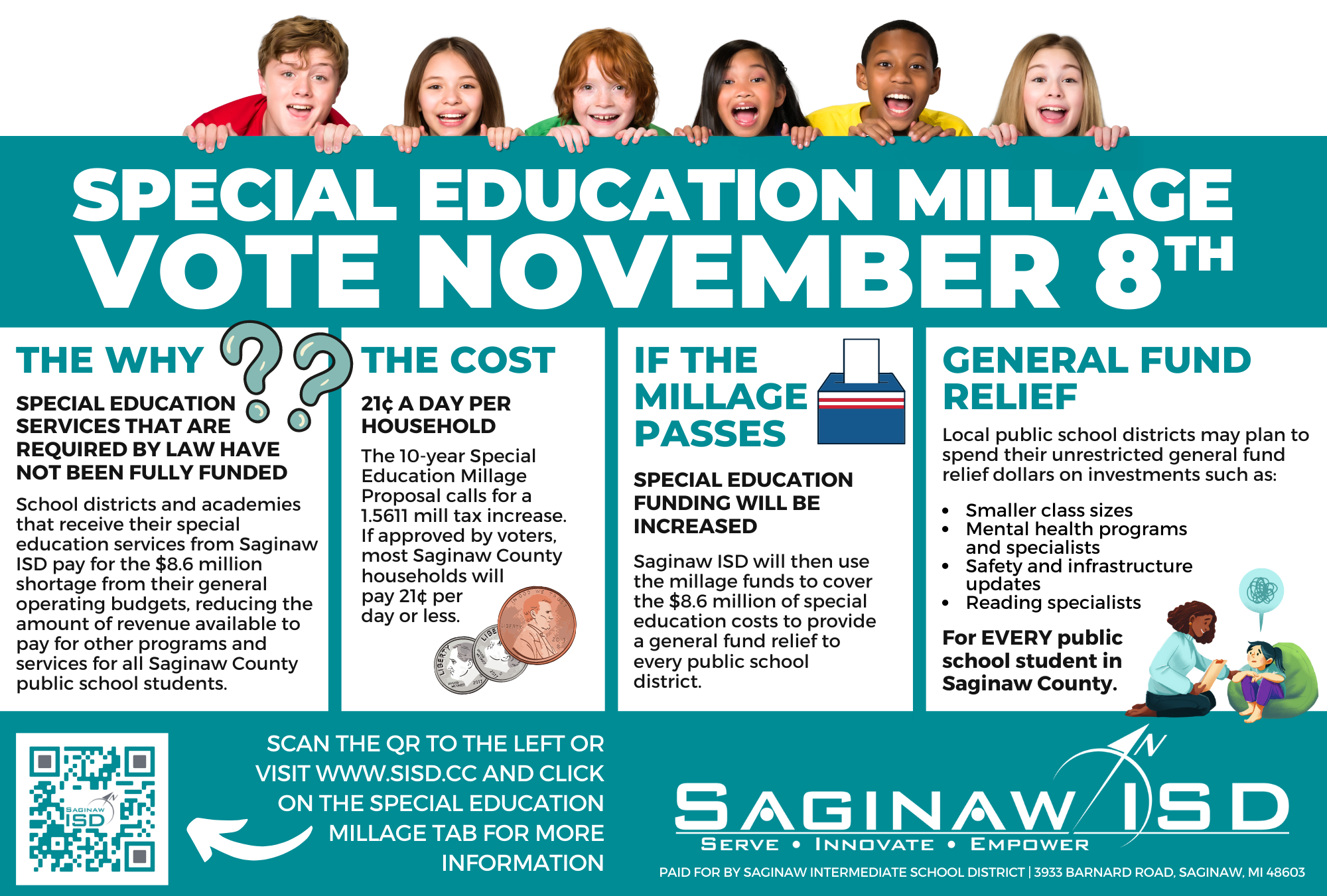

SAGINAW INTERMEDIATE SCHOOL DISTRICT SPECIAL EDUCATION MILLAGE PROPOSAL

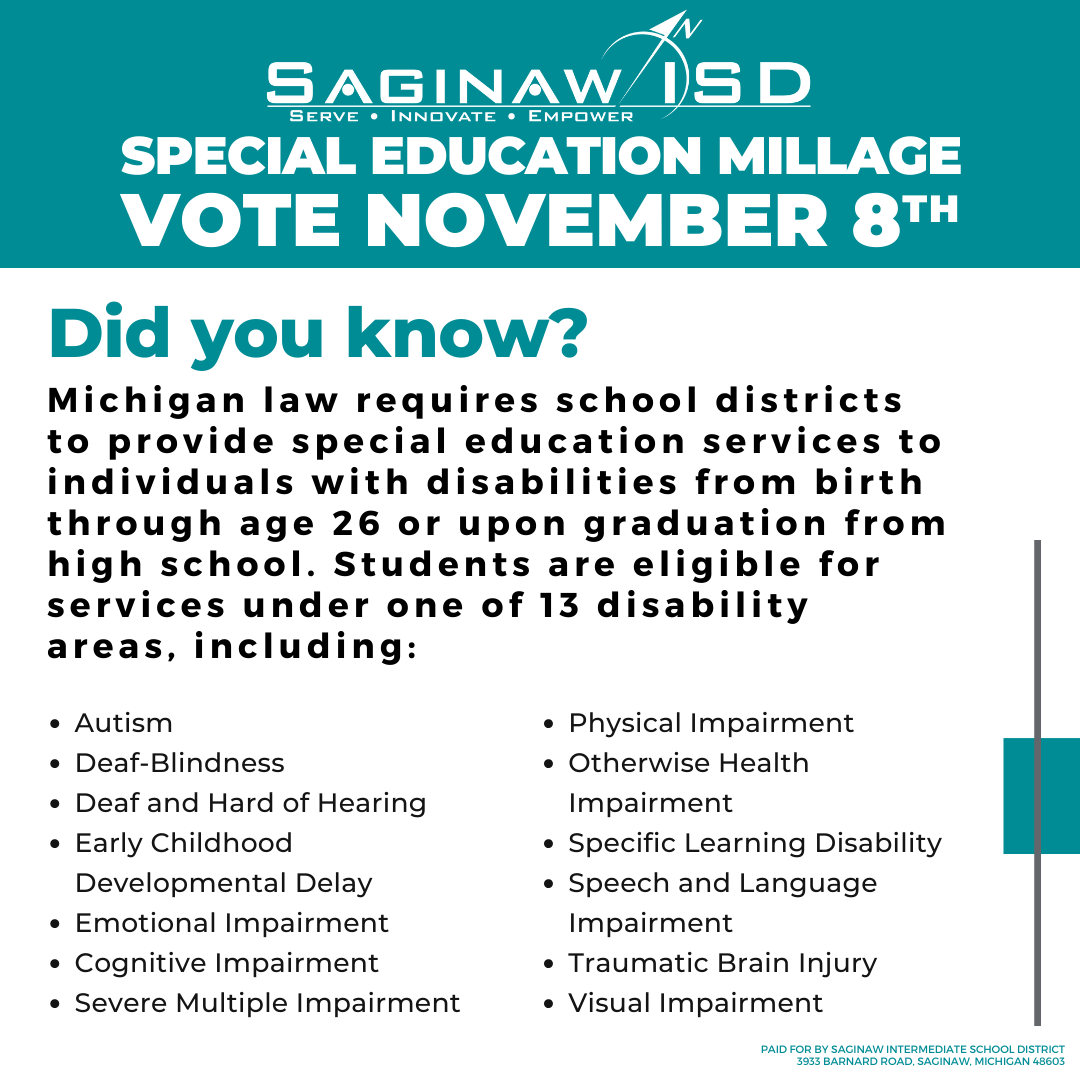

This proposal will increase the levy by the intermediate school district of special education millage previously approved by the electors. Shall the 1.9389 mills limitation ($1.9389 on each $1,000 of taxable valuation) on the annual property tax previously approved by the electors of Saginaw Intermediate School District, Michigan, for the education of students with a disability be increased by 1.5611 mills ($1.5611 on each $1,000 of taxable valuation) for a period of 10 years, 2022 to 2031, inclusive; the estimate of the revenue the intermediate school district will collect if the millage is approved and levied in 2022 is approximately $8,653,163 from local property taxes authorized herein?

TOP 5 QUESTIONS

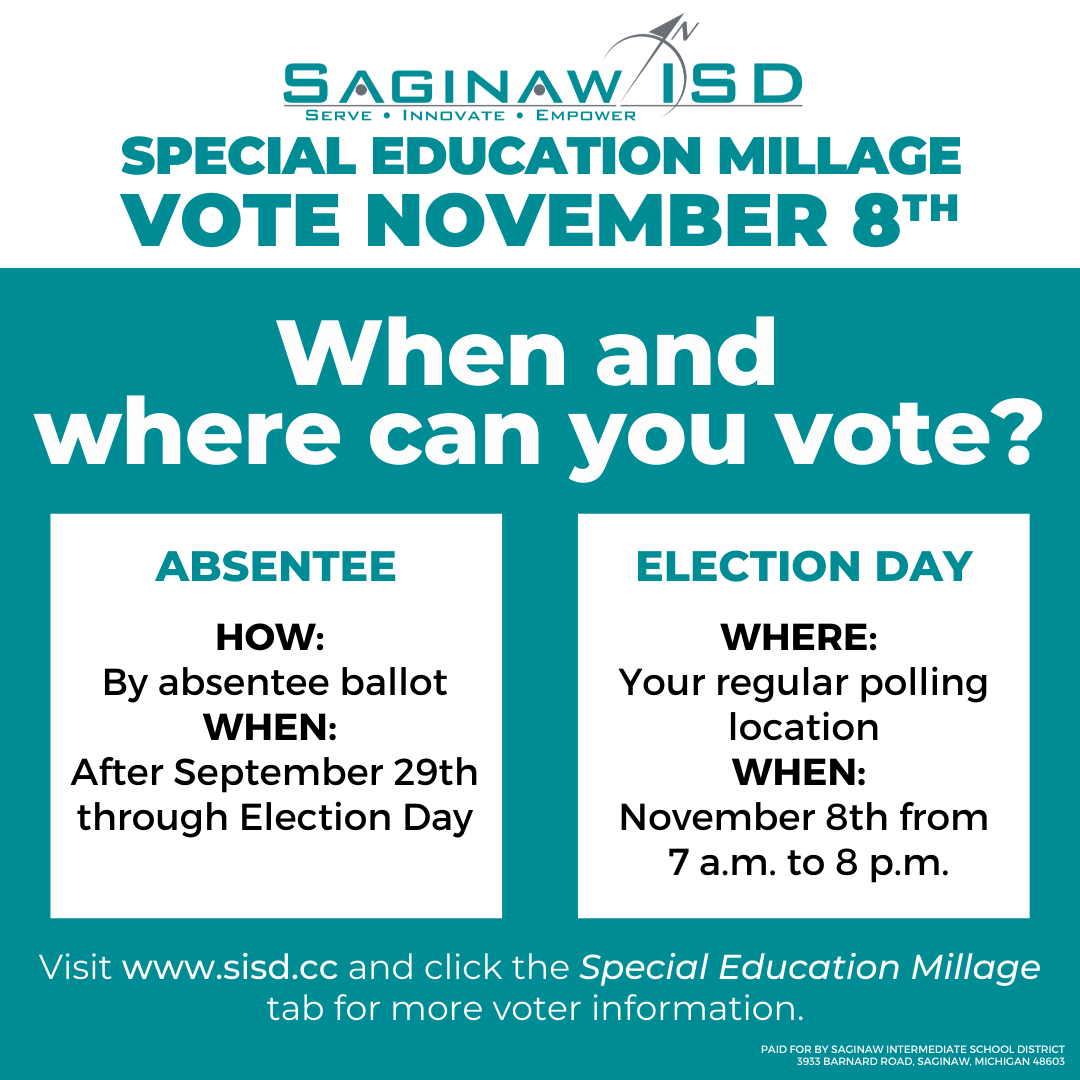

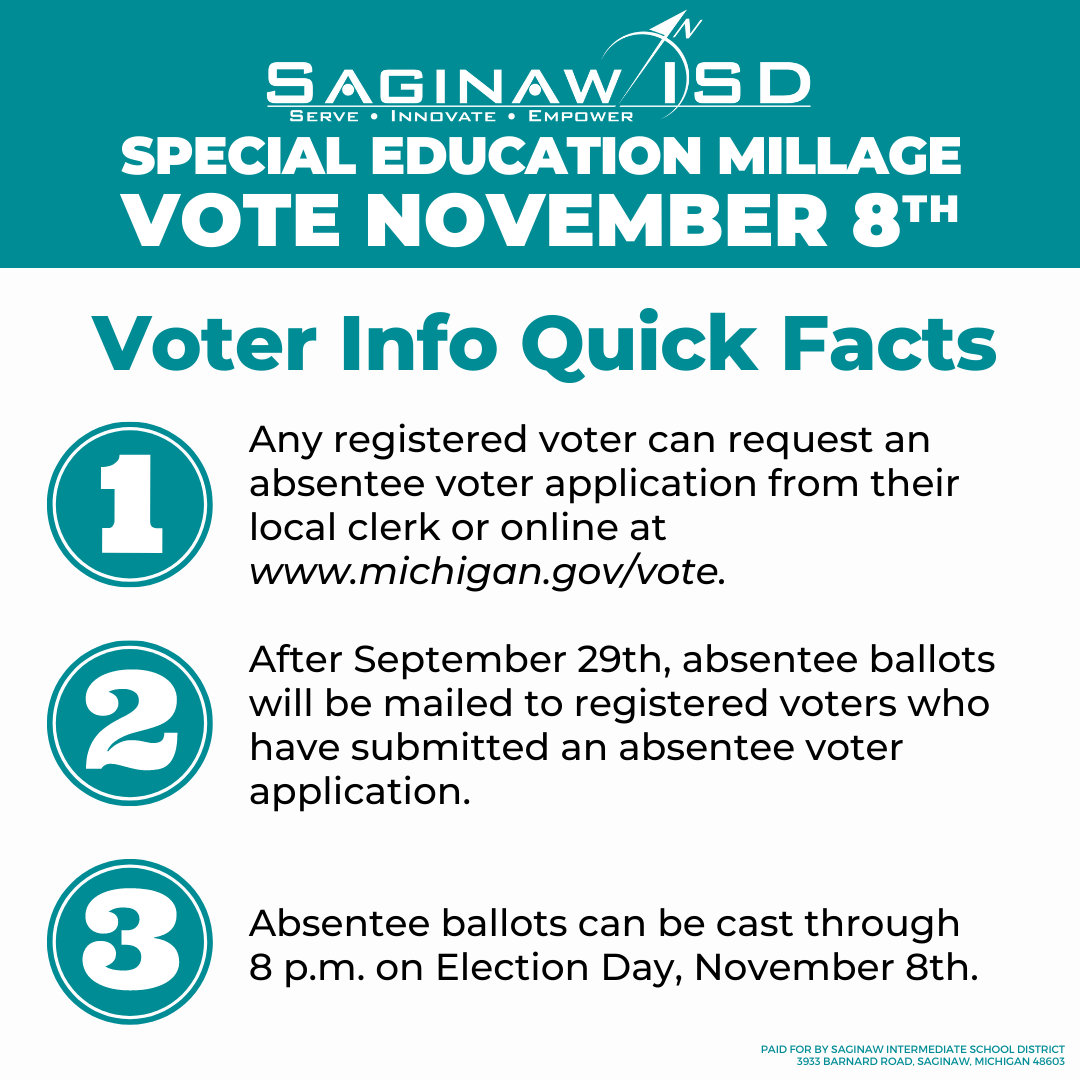

SHAREABLE SOCIAL MEDIA IMAGES

HOW TO SHARE: Right-click the illustration that you want to save as a separate image file, and then click Save as Picture. Once you have chosen where to save it on your device (Downloads, Files, Documents, Photos, etc.) go to your preferred method of communication and share to friends and family that would like more information on the upcoming millage proposal.